aurora sales tax rate

2020 rates included for use while preparing your income tax deduction. 2020 rates included for use while preparing your income tax deduction.

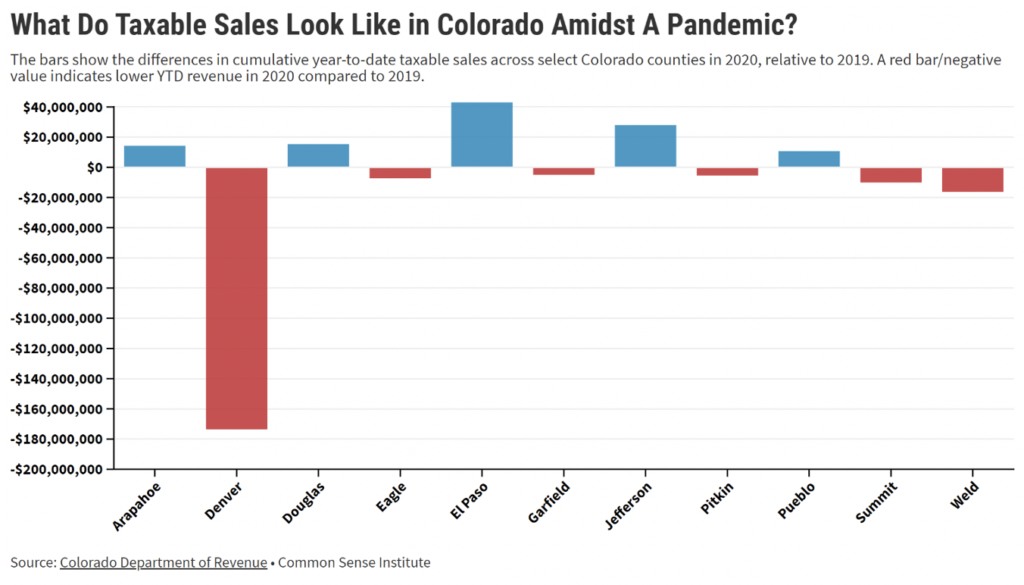

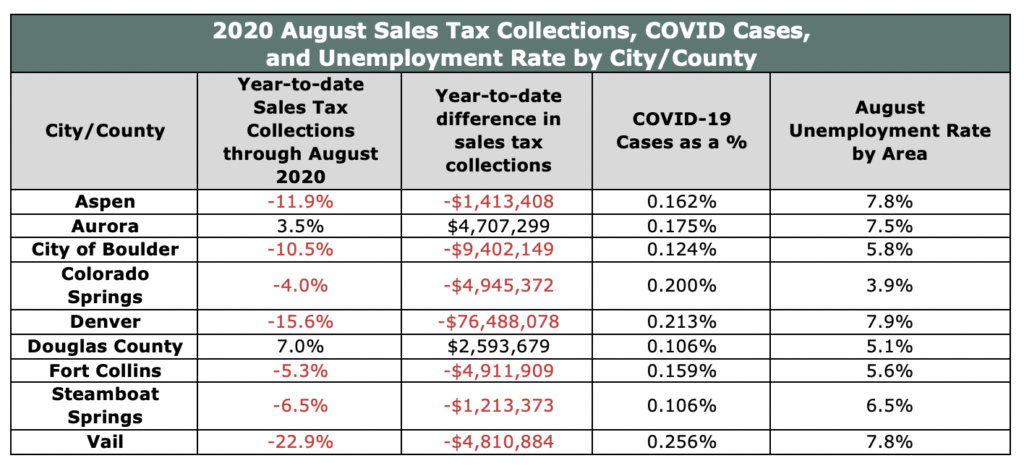

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

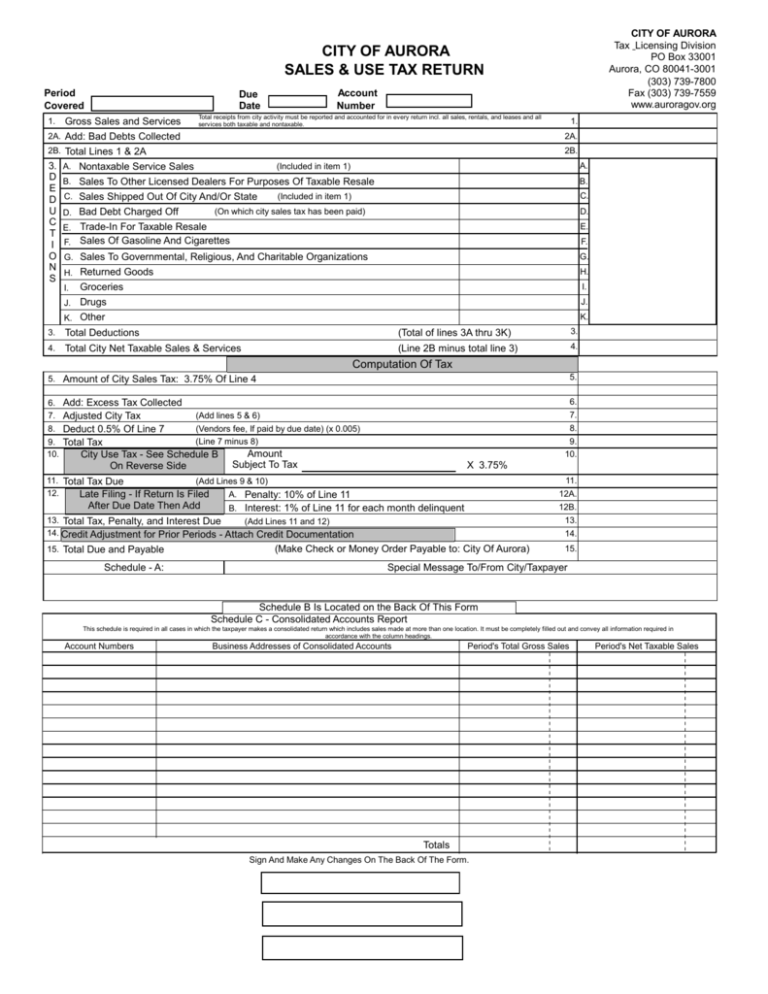

File Aurora Taxes Online.

. 2020 rates included for use while preparing your income tax deduction. 0875 lower than the maximum sales tax in NY. This is the total of state county and city sales tax rates.

The 825 sales tax rate in Aurora consists of 625 Illinois state sales tax 125 Aurora tax and 075 Special tax. This rate includes any state county city and local sales taxes. The 8 sales tax rate in Aurora consists of 4 New York state sales tax and 4 Cayuga County sales tax.

What is the sales tax rate in Aurora Colorado. There is no applicable city tax or. The 55 sales tax rate in Aurora consists of 45 South Dakota state sales tax and 1 Aurora tax.

There is no applicable. This rate includes any state county city and local sales taxes. The exemption from City sales and use tax is eliminated with the passage of ordinance number 2019-64.

Retailers are required to collect the Aurora sales tax rate of 375 on cigarettes beginning Dec. The Aurora Colorado sales tax is 800 consisting of 290 Colorado state sales tax and 510 Aurora local sales taxesThe local sales tax consists of a 025 county sales tax a 375 city. This sales tax will be remitted as part of your regular city of Aurora sales and use tax filing.

2020 rates included for use while preparing your income tax deduction. The minimum combined 2022 sales tax rate for Aurora Minnesota is. The current total local sales tax rate in aurora co is 8000.

The latest sales tax rate for Aurora OH. 2020 rates included for use while preparing your income tax deduction. This is the total of state county and city sales tax rates.

Wayfair Inc affect Colorado. This rate includes any state county city and local sales taxes. The Aurora Cd Only Colorado sales tax is 700 consisting of 290 Colorado state sales tax and 410 Aurora Cd Only local sales taxesThe local sales tax consists of a 025 county sales.

The latest sales tax rate for Aurora IN. The Aurora Nebraska sales tax is 550 the same as the Nebraska state sales tax. This rate includes any state county city and local sales taxes.

Annually if taxable sales are 4800 or less per year if the tax is less than 15 per month. The minimum combined 2022 sales tax rate for Aurora Colorado is. The County sales tax rate is.

This rate includes any state county city and local sales taxes. Remember that zip code boundaries dont. Quarterly if taxable sales are 4801 to 95999 per year if the tax is less than 300 per month.

What is the sales tax rate in Aurora Nebraska. 275 lower than the maximum sales tax in IL. This is the total of state county and city sales tax rates.

2020 rates included for use while preparing your income tax deduction. The latest sales tax rate for Aurora CO. 5 lower than the maximum sales tax in SD.

Did South Dakota v. This rate includes any state county city and local sales taxes. The latest sales tax rate for Aurora MN.

There are approximately 213758 people living in the. This rate includes any state county city and local sales taxes. 2020 rates included for use while preparing your income tax deduction.

While colorado law allows municipalities to collect a local option sales tax of up to 42 aurora does not currently. If the due date 20 th falls on a weekend or holiday the next business day is considered the due date. This is the total of state county and city sales tax rates.

The minimum combined 2022 sales tax rate for Aurora New York is. There is no applicable county tax or special. An alternative sales tax rate of 881 applies in the tax region Denver which appertains to zip codes 80010 80012 80014 and 80019.

The latest sales tax rate for Aurora OR. The latest sales tax rate for Aurora IL. The minimum combined 2022 sales tax rate for Aurora Nebraska is.

The Aurora sales tax rate is. This rate includes any state county city and local sales taxes. The latest sales tax rate for Aurora SD.

The latest sales tax rate for Aurora MO. The Aurora Nebraska sales tax rate of 55 applies in the zip code 68818. The Colorado sales tax rate is currently.

What is the sales tax rate in Aurora New York. 2020 rates included for use while preparing your income tax deduction. There are approximately 4755 people living in the Aurora area.

What is the sales tax rate in Aurora Minnesota. While many other states allow counties and other localities to collect a local option sales tax Nebraska.

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Kansas Sales Tax Rates By City County 2022

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Sales Tax Revenue In Colorado Cities Since Start Of The Pandemic Common Sense Institute

Aurora To Become First Colorado City To Exempt Diapers Adult Incontinence Products From City Sales Tax

Illinois Car Sales Tax Countryside Autobarn Volkswagen

2017 Effective Property Tax Rates In The Collar Counties The Civic Federation

Colorado Sales Tax Rates By City County 2022

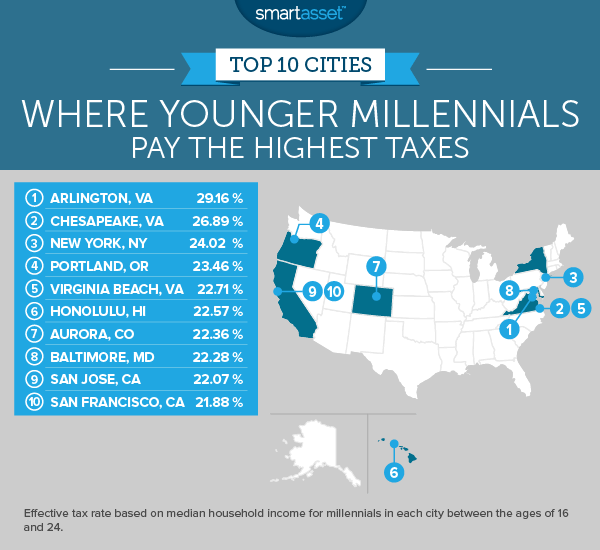

Where Millennials Pay The Highest Taxes 2017 Edition Smartasset

How Colorado Taxes Work Auto Dealers Dealr Tax

Estimated Effective Property Tax Rates 2008 2017 Selected Municipalities In Northeastern Illinois The Civic Federation

Nebraska Sales Tax Rates By City County 2022

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute

Aurora Kane County Illinois Sales Tax Rate

Are Denver Taxes Too High The Fiscal Impacts Of Ordinance 304 Enough Taxes Already Common Sense Institute